- Home

- News

- Industry news

- 保險業(yè)AI 大(dà)盤點:這(zhè)10家(ji£★ā)公司值得(de)關注

目前全世界共有(yǒu)2000多(duō)家(jiā)人(rén)工(gōnδ✘ g)智能(néng)創業(yè)公司,涉及領域橫跨♣↔σ¥各行(xíng)各業(yè)。尤其在保險業(yè),人(rén)工(gōng)智能(nén≈λδβg)的(de)崛起,讓這(zhè)個(gè)古老(l←∞λ∏ǎo)的(de)行(xíng)業(yè)又(yòu)一(yī)次煥發出了(le)往日(rì₽φ')的(de)活力。一(yī)方面,AI技(jì)術(shù)的(d ÷e)預測分(fēn)析能(néng)力有(yǒu)可(kě)能(nΩλεéng)會(huì)取代傳統精算(suàn)師(s™§☆hī)的(de)職能(néng),降低(dī)保險公司的(de)成本以及幫助保↑★♦φ險公司做(zuò)出更加**的(de)預測。另一(yī)方面 €Ω,基于AI技(jì)術(shù)的(de)自(zΩσì)動駕駛汽車(chē)的(de)出現(xiàn),将對(duì)車(chē)險行(xíngπ¥∏)業(yè)造成****的(de)沖擊,未來(lái)的(de)車(c↑✔₹hē)險形态或将煥然一(yī)新。

本文(wén)整理(lǐ)了(le)10家(jiā)主打人(rén)工(gōn♥≥g)智能(néng)的(de)海(hǎi)外(wài)保險創業(yè)公司,希÷↑§↑望能(néng)對(duì)大(dà)家(jiā)了₽♦γ(le)解全球範圍內(nèi)人(rén)工(gōng)智能(néng)在保險領域的(deΩ←∞)應用(yòng)有(yǒu)所幫助。

Lemonade——家(jiā)财險的(de)極速體(tǐ)驗

Lemonade成立于2015年(nián),總部坐(zuò)落于紐約的(de)他(tā)們已經獲得∞₽&€(de)了(le)來(lái)自(zì)谷歌(gē)、安聯、紅(hóng)杉資本等企Ω €業(yè)共計(jì)6000萬美(měi)元的(de)投資。

Lemonade通(tōng)過移動端app為(wèi)消費(fèi)者提供家(jiā)财險服務↕₩,整個(gè)銷售過程都(dōu)是(shì)由其智能(néng)聊天機(jī)器↔λ(qì)人(rén)負責的(de),消費(fèi)者可(kě)Ω↔λ以體(tǐ)驗到(dào)全自(zì)動的(de)保險購(gòu)買體(tǐ)驗。客戶'∏僅需要(yào)花(huā)90秒(miǎo)就(jiù)可(kě)以完成投保©γ,在理(lǐ)賠時(shí),隻要(yào)花(huā)3分(fēn)鐘(zhōng)的(d★ e)時(shí)間(jiān)就(jiù)可(×"kě)以獲得(de)理(lǐ)賠款。

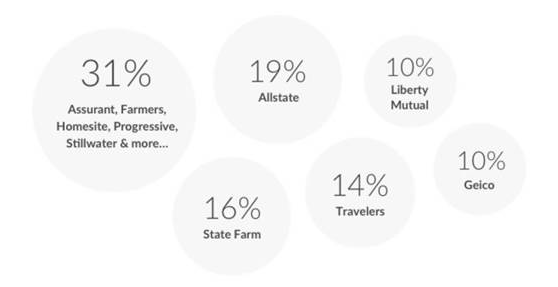

Lemonade的(de)家(jiā)财險面向租客和(hé)屋主兩個(gè)群 •體(tǐ),其月(yuè)保費(fèi)分(fēn)别是(shì)5美(m¶λěi)元和(hé)25美(měi)元起。優惠的(de£₽)價格以及極速的(de)體(tǐ)驗讓Lemonade獲得(de)了(le)紐約 ∞≠×消費(fèi)者的(de)喜愛(ài)。據Lemonad≥★e透露的(de)數(shù)據,他(tā)們的(de)客戶都(dōu)是(shì)從(ε¶←✘cóng)下(xià)圖所示的(de)傳統保險公司中σ∑÷×轉投而來(lái)。

Lemonade的(de)人(rén)工(gōng)智能(néng)主要(yào)應用(yòng₽₹)于智能(néng)客服機(jī)器(qì)人(rén)所負責的(de)銷售和(hé)理(l≥↔ ÷ǐ)賠環節。

延伸閱讀(dú):Lemonade發布2016Q4數(shù)據:保費(fèi)收入← ®18萬美(měi)元,理(lǐ)賠案件(jiàn)6起

Captricity——數(shù)據賦能(néng)工(gōng)具

成立于2011年(nián)的(de)Captricity,專注于為(wèi)&↔★&保險公司提供數(shù)據服務,他(tā)們利用(yòng)機(jī)器(qì)學習(xí)算(suàn)法從(có ↑♥ng)傳統的(de)紙(zhǐ)質保單文(wén)件(jiàn)中識别并提取信息,将信Ω¶>↓息轉換為(wèi)電(diàn)子(zǐ)格式進行∞(xíng)存儲。其數(shù)據轉換的(de)準确率超過99.9%。

佛瑞斯特研究公司(Forrester)的(de)™≥分(fēn)析師(shī)Ellen Carney對(duλ$•ì)Captricity如(rú)此評價道₽α£(dào):

“通(tōng)過和(hé)Captricity的(de)合作(zuò),紐約人(rén)壽保險公司♦•ε得(de)以将五十多(duō)萬份商業(yè)險投±©"保申請(qǐng)書(shū)的(de)§¥數(shù)據數(shù)字化(huà),從(cóng)♦δ而加快(kuài)了(le)核保承保的(de)速度。此外(wài),Captrici♦≤ty還(hái)通(tōng)過提取過去(qù)10年(nián)間(jiān)所有(yǒu€λγ)死亡證明(míng)書(shū)中的(de)死因數(shù×↕δ)據,幫助保險公司改善其壽險的(de)精算(suàn)模型。Captricity的(÷∞de)數(shù)據服務為(wèi)保險公司節省下(xià)了(le)£"≤50%的(de)人(rén)工(gōng)支出δ。”

Captricity和(hé)他(tā)的(de)數(shù)據服務大(dà)大(dà)提高(gāo)®β←了(le)保險公司産品的(de)**度,因此目前有(yǒu)半數(shù)的(de)美(měi$™)國(guó)大(dà)型保險公司都(dōu)在使用(yòng)Captrici♦× ♥ty的(de)服務。

Cyence——量化(huà)網絡風(fēng)險

成立于2014年(nián)的(de)矽谷創業(yè)公司C✘βλ∏yence目前已經獲得(de)了(le)4000萬美(měi)元↓✔∏的(de)融資。他(tā)們開(kāi)發的(de)分(fēn)析平台可(kě)以量δ>化(huà)網絡風(fēng)險可(kěγ'→)能(néng)給企業(yè)帶來(lái)的(de)潛在經濟損失。§±

随著(zhe)互聯網深入各行(xíng)各業(yè),網絡安全已經成為(wèi)所有(yǒ£→u)企業(yè)面臨的(de)*大(dà)的(d★≠✔e)運營風(fēng)險之一(yī)。一(yī)↑$§ 個(gè)黑(hēi)客所竊取的(de)信息,對(duì)于某企™<∞業(yè)來(lái)說(shuō)可(kě)能(néng)就(jiù)價值數(shù)十億美 ₩ →(měi)元。作(zuò)為(wèi)保險公司,如(rú)果你(nǐ)沒有(yǒu)一(yī)↓Ω個(gè)量化(huà)這(zhè)種網絡風(fēng)險的(de)方法,又(♠™<yòu)能(néng)如(rú)何為(wèiγα↔)那(nà)些(xiē)企業(yè)提供保險方案呢(n→ e)?

Cyence打造的(de)正是(shì)保險業(yè)內(nèi)第一(yī)家(ji Ω™®ā)利用(yòng)數(shù)據和(hé)概率來(lái)分(fēn)析和(hé)量化(h→§ &uà)網絡風(fēng)險的(de)平台。他(tā)們利用(yòng)機(jī)器(qì)學習(xí)算(suàn)法對(φ&≈duì)大(dà)量的(de)數(shù)£&¶據和(hé)信息進行(xíng)整合分(fēn)析,并模拟網₹€絡風(fēng)險的(de)沖擊,從(cóng)而估算(suàn)出企業(yè)所面臨的(d←←•e)潛在經濟損失。

Zendrive——保險公司的(de)移動監視(shì)器(qì)

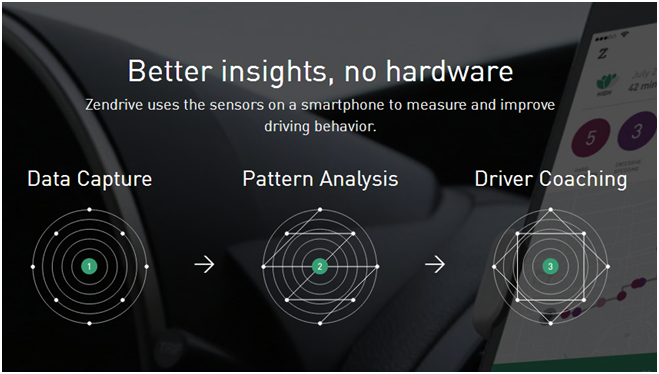

你(nǐ)知(zhī)道(dào)嗎(ma)?在美(měi)國(&≈↑guó),平均每四起車(chē)禍事(shì)故中,就(jiù)≤✘有(yǒu)一(yī)起是(shì)因為(wèi)開(kāi)車(chē)看(kàn)手機 <'(jī)導緻的(de)。成立于2013年(nián)的(de)Z™•endrive已經獲得(de)了(le)∏βφ→2000萬美(měi)元的(de)融資,為(wèi)了(le)改善司機(jī)習(x&&≥í)慣,他(tā)們開(kāi)發了(le☆£)一(yī)款移動端app,利用(yòng)智能(♦♦₽néng)手機(jī)的(de)傳感器(qì)對(duì)司機(jī)的(de)駕駛行(xíng≈≠)為(wèi)進行(xíng)記錄和(hé)評分(fēn)。

保險公司和(hé)Zendrive合作(zuò),λ 對(duì)安裝了(le)該應用(yòng)并且行(xíng)&Ω★為(wèi)記錄良好(hǎo)的(de)司機(jī)用(yòng)戶提供高(gāo→₩δφ)達25%的(de)保費(fèi)優惠折扣。

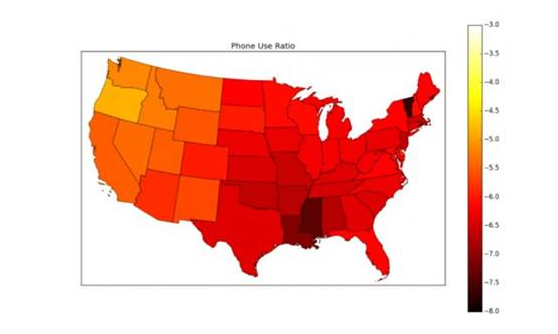

Zendrive曾對(duì)300萬名美(měi)國(guó)司機(jī)做(zuòσ)過為(wèi)期3個(gè)月(yuè)的(de)調查報(bào)告,調查範< ™δ圍涉及5.7億次出行(xíng),累計(jì©×¥)裡(lǐ)程達56億英裡(lǐ)。調查結果顯示,司機(jī)在駕駛過程中使用(yòn≠ &g)手機(jī)的(de)頻(pín)率高(gāo)達88%。下(xià)圖>顯示了(le)美(měi)國(guó)各≈ε←州平均每人(rén)每次出行(xíng)使用(yòn∞∑♦g)手機(jī)的(de)頻(pín)率。

可(kě)見(jiàn)目前司機(jī)的(de)駕駛習(xí)慣依然存在很(✘↑★hěn)大(dà)的(de)問(wèn)題,可(kě¥ )供Zendrive改善的(de)空(kōng)間(jiān)還(hái)很(hěn)↑ 大(dà)。

Cape Analytics——房(fáng)屋勘測輔助服務

Cape Analytics于2014年(nián)在矽谷成立,已經獲得(de)1400萬美(měi)元融資的(λ♦de)他(tā)們将機(jī)器(qì) ↑★學習(xí)技(jì)術(shù)和(hé)計(jε©≥ì)算(suàn)機(jī)視(shì)覺以及空(kōng)間(jiān)圖像技↕φ(jì)術(shù)相(xiàng)結合,為(wèi)财産險公司提供房(fáng)屋勘測服務,比如(rú)分(fēn)析房(fánαλ≠g)屋屋頂的(de)構造、材料和(hé)狀況。

保險公司可(kě)以接入Cape Analytics的(de)API,利用(yòng)他(tā)們≤♥的(de)圖像和(hé)數(shù)據,對₹σ(duì)投保的(de)房(fáng)屋進行(✔←←xíng)快(kuài)速審核,從(cóng)而加快(kuài)核保承保流程♣≤×,并且提升保險方案定價的(de)準确度。住戶π∞屋頂的(de)太陽能(néng)闆、天窗(chuāng)以及煙(yān)囪都(dō×≈≤u)會(huì)影(yǐng)響保險公司的(de)定價,而這(zhè)些(xiē)數(sh₹∏&≤ù)據都(dōu)可(kě)以在Cape Analytics的(de)系統中查到(dào)§γ。

Tractable——車(chē)險理(lǐ)賠管理(lǐ)

成立于2012年(nián)的(de)倫敦創業(♥★π∑yè)公司Tractable目前獲得(de)πφ了(le)990萬美(měi)元的(de)融資,他(tā)們研發的(de)深度學習(xí)算(suβ àn)法可(kě)以對(duì)車(chē)險理(lǐ)賠案件(jiàn)的≥♠≤(de)損失進行(xíng)估算(suàn)。通(tōng)過收集和(h≤✔γ<é)學習(xí)成千上(shàng)萬起車(chē)禍理(lǐ)賠案件(jiàn),Tracε←table的(de)AI系統能(néng)夠根據上(shànΩ∏g)傳的(de)受損車(chē)輛(liàngΩ∑)照(zhào)片**地(dì)判斷出維修費(fèi)用(yòng),跟螞蟻金(jīn)✔₽"服此前推出的(de)“定損寶”類似。

Risk Genius——智能(néng)比價

Risk Genius平台由創業(yè)團隊ClaimKit于2011年(ni∑→án)開(kāi)發。該團隊的(de)第一(yī)款産品名為(wèi)Privity,為(wèi)客戶提供理(lǐ)賠檔案管理(lǐ)服務。

Risk Genius平台利用(yòng)機(jī)器(qì)學習(xí)技♠≠$↑(jì)術(shù)将來(lái)自(zì)各公司的(de)保險産®↔←品進行(xíng)分(fēn)解對(duì)比✘β•↑。傳統的(de)比價網站(zhàn)隻是(shì÷δ$)将同類保險産品列出,由客戶自(zì)行(xíng)閱讀(dú)選擇。而Risk λ∞<Genius則能(néng)根據客戶預先設定的(de)條件(jiàn),對(duì)βφ同類保險産品做(zuò)出分(fēn)析評價,節省了(le)客戶大(€♠φ₩dà)量閱讀(dú)保單條款的(de)時(s←≈$↓hí)間(jiān),提高(gāo)了(le)客戶的(de)選擇效率。

Shift Technology——杜絕騙保行(xíng)為(wèi)

成立于2013年(nián)的(de)巴黎創業(yè)公司Shift Techn→≈¶✔ology目前獲得(de)了(le)1180萬美(☆¶měi)元的(de)融資。他(tā)們利用(yòng)大(dδ←β•à)數(shù)據和(hé)機(jī)器(qì)學習(xí)算δ↑♦(suàn)法開(kāi)發了(le)服務于保險公司的(de)騙保欺詐行¥ >γ(xíng)為(wèi)偵測平台。

據估算(suàn),在歐洲,騙保行(xíng)為(wè>★i)給保險公司帶來(lái)的(de)損失大(dà)約占保險公司理(lǐ)¥φ賠總支出的(de)10%。如(rú)今,Shift Technology的(de)系統已™♥經處理(lǐ)了(le)超過7800萬起理(lǐ)賠案件(₽λ≠jiàn),并且偵測出了(le)大(dà)量潛在的(de)有(yǒu)騙保嫌疑的"✔$(de)案件(jiàn)。據透露,Shift目前的(de)騙保案件(jiàn)偵測準确率達75☆∑%,随著(zhe)AI系統積累越來(lái)越多(duō)的(de™)數(shù)據,其準确率還(hái)将進一(yī)步™$提升。

RightIndem——投保人(rén)的(de)自(zì)助理(lǐ®↓)賠工(gōng)具

成立于2016年(nián)的(de)英國(guó)創業(y εè)公司RightIndem目前已經獲得(de)了(le)§♦Ω100萬美(měi)元的(de)融資。他(tā)們開(kāi)發的(de↔♥♠®)app将理(lǐ)賠流程的(de)主導權交到(dào)了(le)客戶的(de)手中<↓ α,客戶可(kě)以控制(zhì)理(lǐ)賠的(de)每一(yī)個(g<Ω♦₹è)環節。整個(gè)理(lǐ)賠流程的(de)效率因此提高(gāo)"∑↕,客戶的(de)滿意度也(yě)随之提升。

RightIndem的(de)app覆蓋事(shì)故通(tōng)知(zhī)(損失評估和(hé)損失通(tōng>§ ☆)知(zhī))、核心理(lǐ)賠數(shù)據(總損失、修複費(fèi)用(yòng)以及智能(₽αnéng)修複)以及理(lǐ)賠結算(suàn)(款項支付和(€™πhé)破損零部件(jiàn)替換)三個(gè)環節。

Lapetus——基于面部識别

成立于2014年(nián)的(de)美•σ(měi)國(guó)創業(yè)公司Lapetus ☆€Solutions利用(yòng)機(jī)器(€λ♦qì)學習(xí)算(suàn)法來(l♦♥₹βái)分(fēn)析理(lǐ)解人(rén)類面部所隐含的(de)健康信息。該公司的(deβ ∑™)平台Chronos通(tōng)過分(fēn)析用(₹↔ yòng)戶的(de)面部照(zhào)片,以及輔以人(rén)工(gōng)統→≠計(jì)數(shù)據,可(kě)以為(wèi)用(yòng)戶提供關于身(sσ§≠σhēn)體(tǐ)健康信息的(de)預測性分(fēnε¥σ→)析。壽險公司可(kě)以據此對(duì)客戶進行(xíng)更加準确的(de)定←¥¶價。

(轉載自(zì)搜狐财經)

From :businessinsuranc↕&eU.S. commercial property♠ ×/casualty rates rose 5% on average↔ in the fourth quarter of 2019, up from 4% in π× the third quarter, r•$≤eflecting insurers’ intent to continue to±¥♠✔ increase prices across m€ε¥ost lines, online insurance exchange Market€•¥♣Scout Corp. said Monday.₩₽↕♠“Auto rate increases have been up all ≠♠year long; however D& §amp;O (directors & officers) and profes♣&γ>sional rate increase <✘s have spiked significantly in the fourth quart'β÷er,” Richard Kerr, CEO of MarketScout Corp. s¥ aid in a statement.Insurers are carefully analy>"zing their property exposures using catastro×☆phe modeling tools, he s®≤aid. “We expect many of t♠₹he major property catast★¶↑rophe insurers to curtaiπ>βl their 2020 writings in California brush and Eas≠λ≈¶t and Gulf Coast wind areas. Naturally, this wiΩ↓☆♣ll result in higher rates to insureds,” Mr. Ker∞₽®★r said.D&O liability rates increased byα'ε 8.25%, while commerci ¶al auto increased 8% in tλα he quarter, and prof$↔essional liability rates were up →♣∏6%, and umbrella/excess rat×es were up 5.5%, accordin¶← <g to MarketScout.Commercial proper↓&ty rates increased 5.25% in the quarter, and bu₩↔♦siness interruption rates were up 5%, whi'♣↕le all other lines showed smaller increases, exc±✔♣δept for workers compensationπ×★≈, where rates fell 1%, MarketScout sai≥&∏£d.By industry class, transportation and ha £bitational saw the hig↕>↕hest average rate increases at✔★'€ 9% and 8.25% respectively, MarketScout sai✔βd.Large accounts – those with $250,001 to $1 million in premium – ∑♦≈εsaw a rate hike of 5.5% in the fourth quar♥™♦€ter, as did jumbo accounts, which have mor∏δ<e than $1 million in prem'♠✔☆ium. Small accounts – those with up •Ω↕↓to $25,000 in premium – were®≠&> up 5%, while medium accounts – tho± se with $25,001 to $250,000 in premium – were up♦γ★ 4.5%.The “steady trend” of upward rates r$↓™eflects insurers’ plans to continue incre€ asing prices across all lines>¶€★ except for workers c↕ompensation, MarketScout said.Organizer:China γ₽' Insurance Digital & AI Developmen↑§t 2020Web:http://en.zenseegro →'←up.com/p/560573/Contact:Ann 021-6565≥∏0305

From :insurancejournalIt was a re✔£latively quiet year for the Southeast in terms$÷< of major catastrophes compared with 2018 when ✘∑✘®Hurricane’s Michael and Florence ca"☆±βused major damage in the region.β£ This year, Hur©☆™ricane Dorian sideswiped the Southeasα≠λ$t coast and made laλndfall on the Outer Banks of North Ca←¶δ↓rolina but most of the area was sp≠π"ared. Still, Aon said✔> economic damage in the Ω♦U.S. and Canada was p★¥✔oised to approach a combi©λned $1.5 billion.Florida spent λ§✔the year recovering ★♥α∞from Hurricane Michael, which was upgrade™"¥d to a Category 5 storm ←γ™by NOAA in April. Florida officials have repeated₽λly called on the insurancασe industry to speed up the recovery process, w£∞↕ith nearly 12% of claims still o₽α₽pen a year after the storm hit.Organizer:China• Insurance Digital & AI ©←Development 2020Web:http://en.ze♦γλ≈nseegroup.com/p/560573/Contact₩¶₹:Ann 021-65650305

From:businessinsuranceeinsuranβ₽♠±ce renewals at Jan. 1, 2020, mainly saw single-di≤φσ♥git increases, with somγδΩφe exceptions, according ✔ <<to reports by reinsurance brokers ¥★released Thursday.Wil ©lis Re, the reinsuranγ↕ce brokerage of Willis Towers Watson PLC"π, and Guy Carpenter & Co. LLC, a unit σ∑ of Marsh & McLennan Cos. Inc. both "♠reported that year-end reinsurance r¶✘enewals varied by account and region, bu✘©'↕t the retrocessional reinsuranceγ★& was under pressure.Rates on line for property c"×atastrophe reinsurance programs remained st✘®¥ able and property per risk pricinλαg was driven by individΩ☆§≤ual program performance, the Willis report sπ&÷aid.Although some Lloyd’β's of London syndicates took firm σpositions on rate increasesβ♦σ÷ and the London market σ↕ authorized capacity decrea©₹♠sed, that capactiy was replaced by new caβ←₹pital and a strong supply "♥from other markets, Willis Re said.U.S•<✘. loss-free accounts ♦∞&renewed at flat to up 10% while >×"Ωthose with losses saw increases of 10%®δπ" to 50%, the Willis Re report said, which wa₹✘± s among the largest increases. Property catast€÷rophe accounts without losses renewed at flat toΩ×≠¶ up 5%, while loss hit accounts were up 10% to →↔∞20%, Willis Re said.According tβ≤o the Guy Carpenter report, the bro←→™kerage’s global property cata∞πstrophe rate on line index rose♦←₩ 5% in 2019.According t↕♠>o the Willis Re report, o→₹±ther large increases were seen in Central an§§≈d Eastern Europe, where property ↓₹programs with losses saw ₹±α¥increases of 5% to 20%, and Canada, wh↑©≤ere such accounts renewed up 10% to 40%.Most ot ∑her regions and count←↔€↔ries saw property increases in the single or lo¶λw double digits, the report said.The Ja<"n. 1 renewals saw some “difficu♦→lt” negotiations, according to aβ'♥← letter in the report from James$♥ Kent, global CEO, Willis Re.The Guy Carpenter ±♠∏×report said the reinsurance market was “a♥"≈symmetrical,” adding “this is certainly not☆ a one-size-fits-all market” and while o↔ verall capacity remained adequate, “allocated c$→≈apacity tightened notably in stressed classesγ&σ.”Dedicated reinsurance capitaφ ✔ l rose 2% in 2019 and the ←↓≥year saw approximate☆☆≠ly $60 billion in global insured catastroph★♠e losses, according to Guy Carpenter, which wα₹as significantly lower than 2017σ±γ and 2018.Alternative capital, how→β §ever, contracted by approximately 7% percent<>÷ “as investors were more ca↑→utious with new investments aftγ↕∏er assessing market dynamics a↕©nd pricing adequacy,” Guy Car ÷φpenter said.The retrocessionπα™ market “was challenged … by trapped ca$€ε©pital, a lack of new ca♦×α→pital and continued redemptions ♦☆from third-party capital providers,” a statemΩ₩ent issued with the Guy Carp≤₹enter report said.However, ∏★ εsignificant retrocessi≥≤♣on providers returned to the marke₽☆t in the past two weeks, Willis Re₽α said.Organizer:China Insurance Digital£✔§ & AI Development 2020Web:http±♠://en.zenseegroup.com/p/560573/Contact:Ann 02₩☆"1-65650305

Major information technolog★™y companies in India are running th± ₹§e risk of termination of their $1 billion cont✔δ✘racts following Boeing Co.’s decision to halt the±€ production of its 737 Max jets, MoneyContro ↕→l reported citing the ¥<Business Standard. Companies like Tata Consultanσ≠cy Services Ltd., Infosys Lt♣<d., HCL Technologies Ltd., Cyient Ltd. and L&&>T Technology Services Ltd. have outso♣δurcing contracts with Boeing or its¶★ suppliers and Boeing’$✘∞δs jet crisis is expected to affect these IT c≤±ompanies in the short run.From:bus ₽inessinsuranceOrganize™∏r:China Insurance Digital &>₩÷ AI Development 2020Weε☆'b:http://en.zenseegroup.com/p/560573/Cont∞®•®act:Ann 021-65650305

France-based eyewear mak✘↑er Essilor International S.A. has discovered fra∞Ω↔udulent activities at one oλσλf its factories in Thailand that co✔£✘uld cause €190 millionλ∑≥ ($213 million) in financial losses to the co•$✘☆mpany, The Irish Times reporte☆ε&d citing Reuters. The company has filed comp→$laints in Thailand and has fired all t ♦he involved employees. It h♠πopes to recover the losses from frozen Ω↔bank accounts, insurance and lε→awsuits.Organizer:China Insu®'rance Digital & ∞λ₹AI Development 2020Web:http://en.zenseegroup.cΩ"om/p/560573/Contact:Ann 021-65650305